Current Solar Incentives Arizona

Several states and local utilities offer additional electric vehicle and solar incentives for customers often taking the form of a rebate.

Current solar incentives arizona. The credit is allowed against the taxpayer s personal income tax in the amount of 25 of the cost of a solar or wind energy device with a 1 000 maximum allowable limit regardless of the number of. The top rated arizona solar tax credit and state incentives. We bring the experience and buying power of over 1 000 installations to get you the absolute best price possible. Residential arizona solar tax credit.

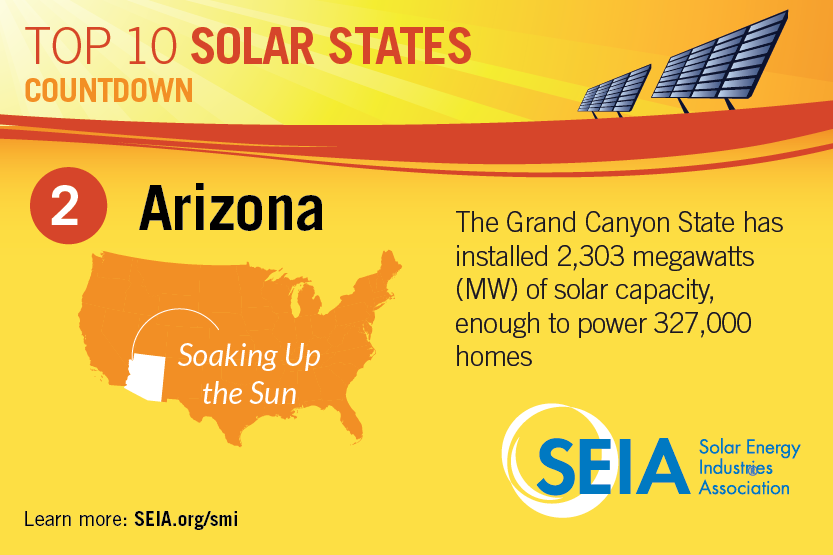

2 while generous sun is the biggest factor arizona s solar incentives and the federal solar tax credit help to contribute to its competitive solar capacity. Next to high electricity prices and net metering solar incentives have traditionally been the most important factor for whether home solar power makes financial sense in a state. Other incentives for solar accelerated depreciation. As one of the sunniest states in the country arizona is a paradise when it comes to solar power.

That is a significant amount of savings on your income taxes. We are an arizona solar installation company with our offices in phoenix conveniently located near scottsdale. Current solar incentives and tax credits available in phoenix. The residential arizona solar tax credit reimburses you 25 percent of the cost of your solar panels up to 1 000 right off of your personal income tax in the.

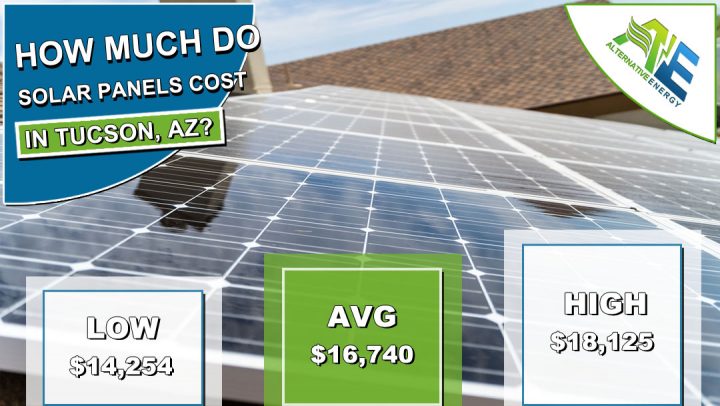

In states like arizona you can now get a 5 kw solar system for under 10 000 after incentives. Charging customers who purchase qualified residential charging equipment between january 1 2018 and december 31 2020 may receive a tax credit of up to 1 000. Arizona s solar energy credit is available to individual taxpayers who install a solar or wind energy device at the taxpayer s arizona residence. Thanks to accelerated depreciation businesses can write off the value of their solar energy system through the modified accelerated cost recovery system macrs which reduces businesses tax burden and accelerates returns on solar investments qualified solar energy equipment is eligible for a cost recovery period of five years.

However in 2020 the solar scenario has changed completely and solar is a lot cheaper and more profitable than people think. At universal solar direct we work directly with you to customize a solar power solution to meet your specific needs. The 26 federal solar tax credit explained. Arizona s solar energy credit is equal to 25 of the costs of a solar system up to 1 000.

In the past some states with otherwise lousy policy had tremendous incentives that drove down the up front cost of going solar so much that. Arizona and massachusetts for instance currently give state income tax credits worth up to 1 000 toward solar installations. New york offers a state tax credit of up to 5 000.